All-in-one Cloud Payroll & HR Platform for the stand-up economy

Right People. Right Job. Right Time. Paid Right

Ready Workforce (powered by zambion) is a true

all-in-one cloud-based solution that caters to the full

employee lifecycle from recruitment to retirement.

Designed with the flexible and modern stand-up economy

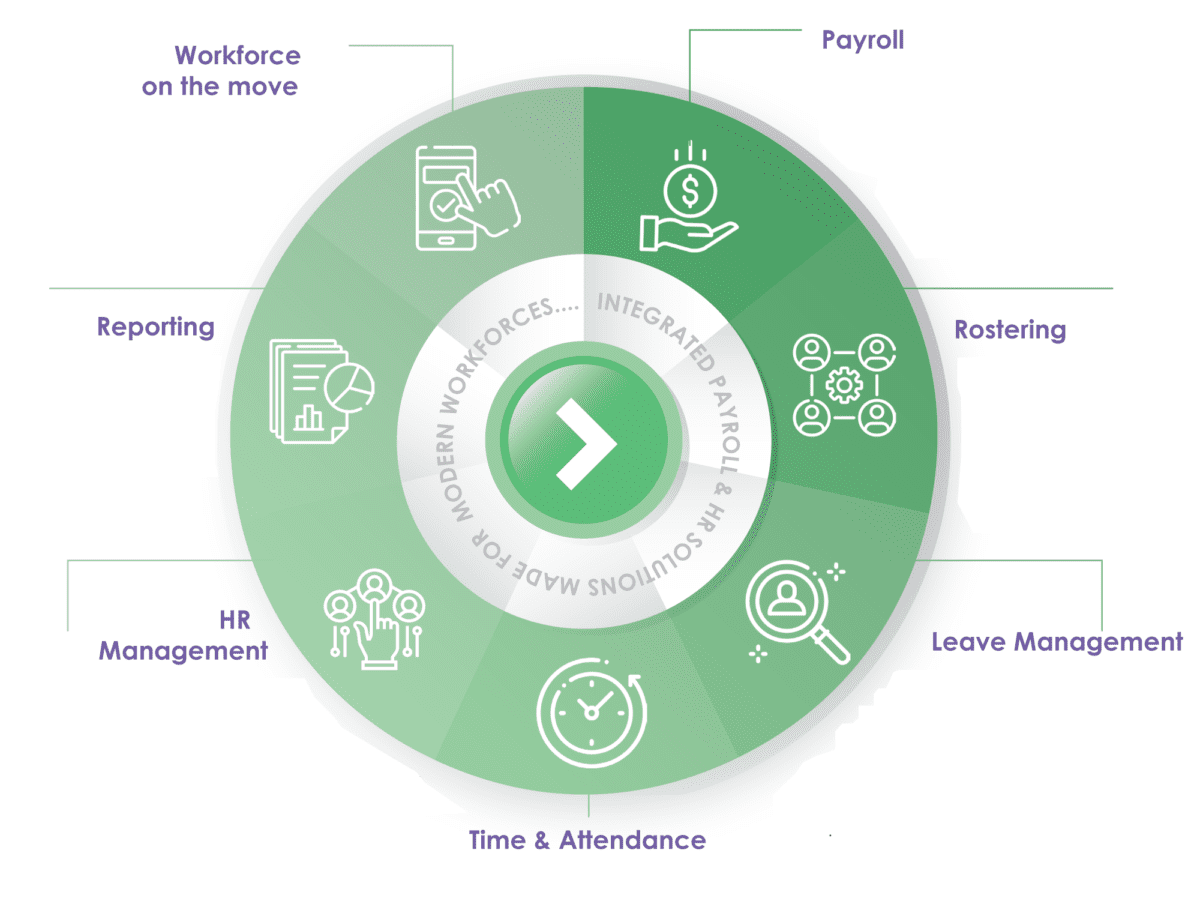

in mind, our intuitive solution empowers businesses with Payroll, HR, Time and Attendance and Leave Management Software accessible anywhere, anytime 24/7.

A state-of-the-art, ATO and IRD compliant Payroll Software that includes contract/awards interpretation calculator. It is designed to encourage collaboration between Finance and HR (or People & Culture Team), with all the important employee details stored in one system.

Ready Workforce easily integrates with existing systems and platforms.

Automated lifecycle workflows to reduce human error and increase productivity.

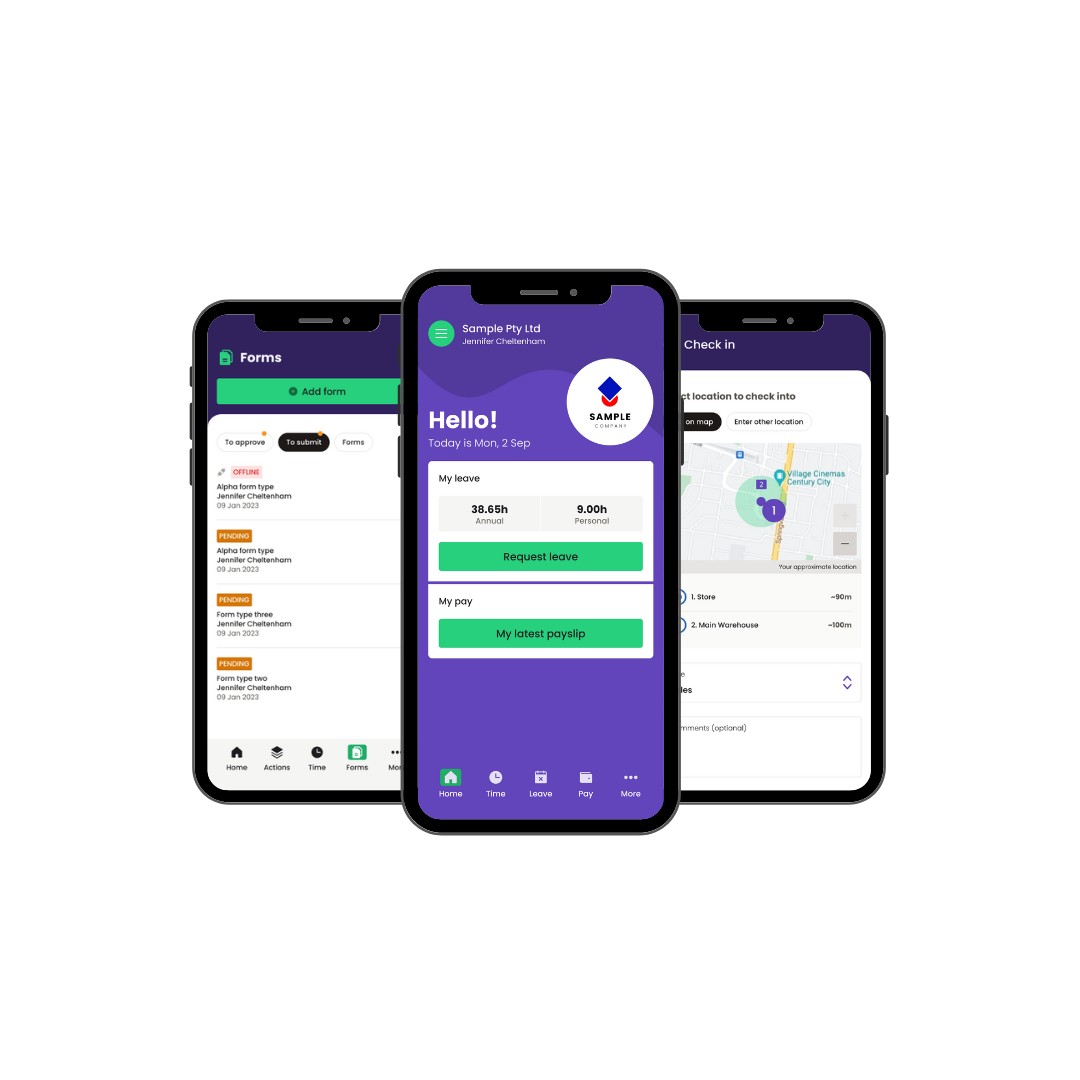

With internet connectivity, employees have access to the app and can self-service from anywhere, anytime, on any device 24/7.

Join the hundreds of businesses and organisations in the ‘stand up economy’ in Australia and New Zealand that are currently using the Ready Workforce Solution:

Streamline your employee management process with Ready Workforce! Our platform offers a wide range of tools to support every step of the employee lifecycle, from recruitment to retirement. Discover our most popular features below.

Employee Self-Service

Forms and Checklists

Human Resources

Reports

Say goodbye to moving from one platform to another to run, manage and view all employee activities.

View all information from a single platform. Integrate with your existing systems. The options are endless.

See Ready Workforce in action.

Book a free demo

For staff: Your employees can self-service wherever they are using the Ready People app. They have the ability to apply for leave, view rosters, manage their timesheets, update their details, submit expense claims, and even do their professional development and OH&S training from the app enables greater flexibility in their busy lives.

For Managers: As long as they have a laptop and internet connectivity, they have the ability to approve timesheets, manage rosters, view reports and communicate with their staff, anytime and from anywhere!

Remove the manual handling and automate your recruitment workflow into the Ready Workforce software at a click of a button using the existing API connection between Ready Employ and Ready Workforce.

Want to find out how the two systems work together?

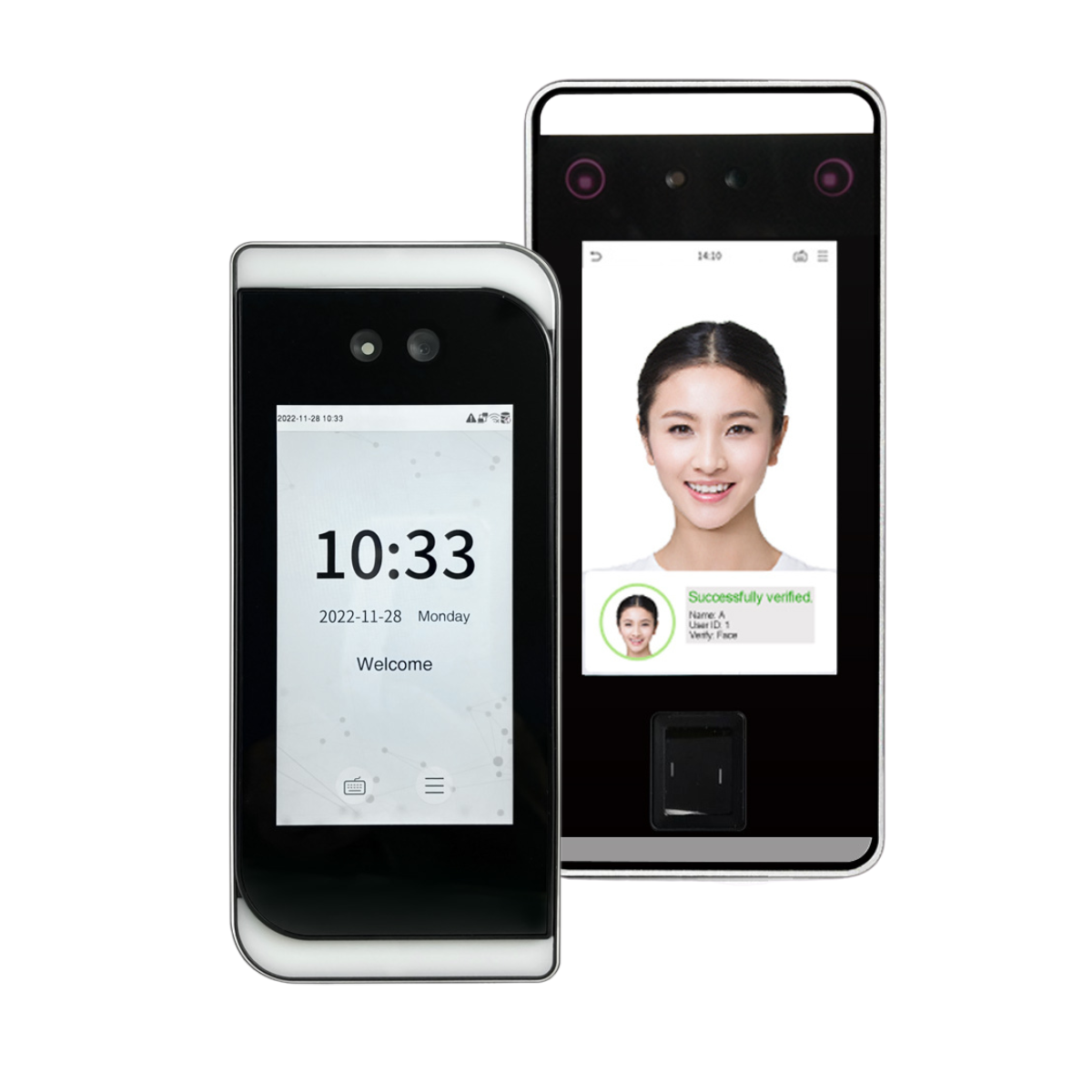

We have scanners that support facial recognition (with and without mask) and verification.

Seamless configuration with Ready Workforce allowing users to clock in/out and have this information updated in their timesheets automatically.

The system provides detailed reporting capabilities, enabling you to analyse

attendance, productivity, and a host of other variables once implemented.

Find answers faster, explore knowledge articles in your own time and ask for support in one central location.

Thousands of Australian and NZ businesses use the Ready Workforce software and trust ReadyTech Workforce Solutions for a streamlined payroll and HR process